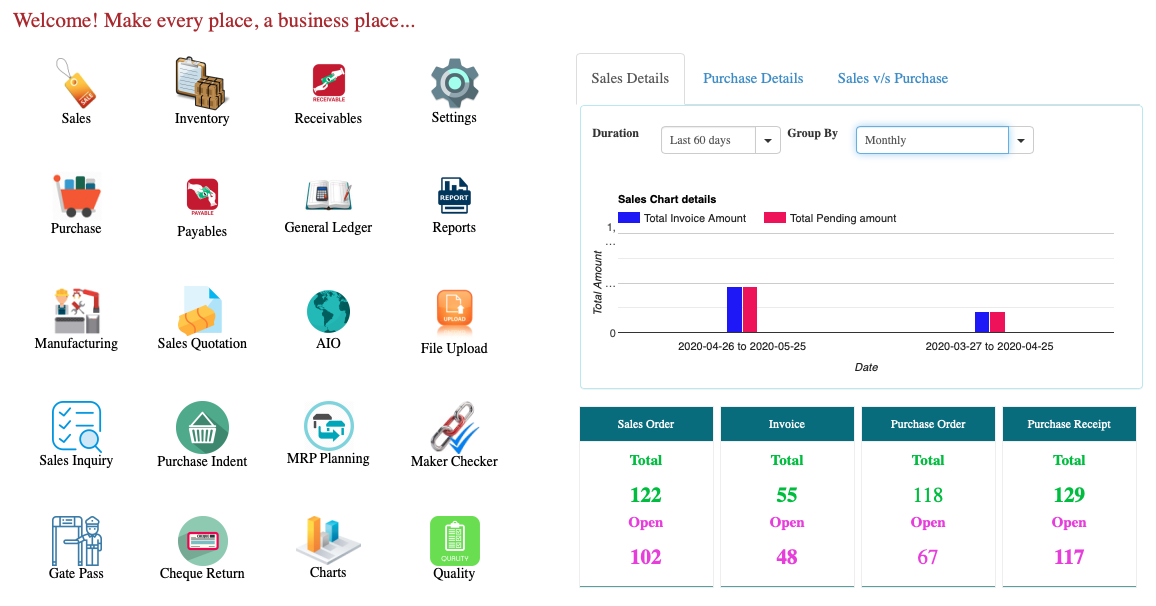

Best Cloud Manufacturing ERP Software Designed for Manufacturing Companies

ACTouch Cloud ERP Software, Sahi Hai.

Integrated Best Manufacturing ERP Software, a right Cloud ERP for you.

ACTouch is a Best Manufacturing ERP Software Solution that offers a comprehensive and Integrated Enterprise Resource Planning System (ERP Software) for Manufacturing Industry. It aids in the Digital Transformation of Manufacturing Companies in the Discrete Manufacturing, Process Manufacturers, Project Based Constructions, Heavy Engineering Industries with Traditional, On-premise and expensive Software.

ACTouch Cloud ERP Platform is a comprehensive manufacturing ERP software that offers real-time data based on customer demands. It integrates various functions such as below.

Supply Chain Management with Sales and Packing Lists

Procurement Cycle with Import Purchases with Landing Costs.

Production Planning and Production scheduling

Customer Relationship management with Lead Management

Material Requirements Planning (MRP)

Project Costs Tracking with Task Completions.

Unlimited levels of Workflow Management tool

Production Management, Work Orders, Shop-floor controls

Inventory control with Inventory management

Quality Controls

General Ledger, Taxes and Financial Controls

Post-sales warranty services.

Integrated Task Management tools across ERP Software

Product Costing and Cost Accounting.

RFQ (Purchase Quotes) Management.

Trusted by Business Managers, Cloud Manufacturing ERP Software Features, to reduce Business complexity with Full & Integrated Automations.

ACTouch, Cloud Enterprise Resource Planning Software, helps DIGITAL Transformation of Your Company.

Now convert your Managers into Business Leaders with Real time Data, Right Tools and Information.

100% Customisable ERP / Configurable ERP for Your Businesses

Easy and Quick ERP Successful Implementation within 41 Days...

We provide 100% post go-live support for ACTouch ERP Cloud Solution.

"You can go live in 41 days with ACTouch Cloud ERP Software or our ERP Implementation services is "FREE" for you"

A personal promise by CEO, ACTouch Technologies.

Benefits of Choosing a RIGHT Manufacturing ERP Software for your manufacturing business. It's 100% Web Based Manufacturing Software

Still You use Excel and Manual Process?

Does your Accounting Software Helps you?

Using Customised ERP? Missing New Developments?

Still using Excel and Manual work with Human errors can affect your Business and Customer Deliveries

As your Business grows, your old Accounting software can not help you. You are a Big Company now

Time to move out of old designed Custom ERP. Move to Best Manufacturing ERP Software now.

Does your Employees are Happy with your current Software to work with?

Is your ERP solve your Business Problems?

Big issue DUE to Stock Loss? Dont know your Raw Materials Status?

1. With ACTouch ERP, now you can avoid Inventory Loss and Raw Materials Wastage.

2. BRANCH and LOCATIONS help you to track EVERY Inventory including at Subcontractor places.

Problems of Document Approvals - Maker Checker?

1. Maker-Checker helps you to Manage your Approval Process.

2. You can enable any DOCUMENTS that you want an approval (Sales Order, Purchase Order, Payments, Delivery Challan etc)

You can find your FG / Inventory COSTS? Do you know how "ABC" solves your Product Costing issues?

1. Do you know your's Inventory / Finished Goods Costs?

2. How can you book your Labor, Materials and Machine costs into Product Costs?

3. We follow a Activity Based Costing (ABC) to arrive at 99.9% accurate product costing.

I have 3 layers of Approvals including Finance Approval? -Workflow Process

1. Workflow enabled decision process solves these problems. You can define even 10 levels of approvals

2. You can set different process like "Upto Rs 50,000 one approval cycle" and "above 50K another approval cycle"

How to Solve your Product Landing cost problems?

Do you know your Imported Product Cost should have Purchase price + Customs Duty + Logistics charges? ACTouch is the 100% solution for your problems.

Import and Export Business with Packing Lists?

Sales Orders with creation of Packing Lists. Helps to manage your Export Business. Our Import Purchase Receipt module helps to manage your Product landing costs.

100% Data Security and 24 x 7 x 365 available

Your data is protected similar to "Banking Level Security". We use Amazon Web Services (AWS) to manage our Data with regular DATA BACKUP etc. Our ERP available 24x7x365

Do you need all Reports in Excel download? Is there any traceability of transactions?

1. Download all your Raw Materials, WIP and FG Data and Reports in Excel Sheet for further Analysis.

2. All your transactions are tracked 100% with who did, when it was done etc with 100% traceability.

Problems in managing Stock with Alternate or Multi Units of measurements (UOMs)

Alternate UOM or Multi UOM with cost management is important for Business and Inventory costings.

You want to reserve Stock for Customer Orders or Projects?

1. in ACTouch ERP, a best Manufacturing ERP Software, now you can RESERVE or BLOCK the stock at Sales Order level for a Customer.

2. When you issue materials to production for a WO, you can block it, so that no one else can use it

Complicated Work Order and Production Reporting?

You can configure your Production Reporting Process either by Configuring Work Order or Production Order processes. All are customisable as per your needs to define ROUTINGS, WORK CENTRE etc

Difficulty in tracking Raw Materials sent to Subcontractor (SC)

1. We identify and track 100% Raw Materials that's sent to a SC including scrap Materials.

2. You can also link your ODC to Inward DC and check the QTY at Subcontractor places easily.

3. Now you can ADD the money paid to Contractor can be added to FG Costs.

Difficulty in Managing Customer JOBWORK Materials

We help to manage and track the customer SENT material to us. Biggest problem is "How to separate our materials with Customer Materials?". No more missing DEADLINES and STOCKs too. Use ACTouch Cloud manufacturing ERP Software.

Data AUDITING and 100% User Access controls.

Earlier days of OLD Software is Over now. Even Government wants and track all Audit trail of transactions and others. They discourage you from deleting any transactions now.

ACTouch Cloud ERP Software, Sahi Hai

A Free ERP Demo may Help you. Schedule an ERP demo.

100% integrated Departments with Process and Controls with 100% Traceability.

A true Cloud Based Production Software for you.

Supply Chain in ACTouch | Procurement Process in ACTouch ERP | Production Controls in ACTouch ERP | Inventory in ACTouch ERP | |

|---|---|---|---|---|

| Track your Pending Sales Orders Download: Pending Sales Order Reports | List of POs that Missed Delivery DUE DATES Download: Pending Purchase Order by Due Date | 100% Tracking of Subcontractor Stocks and Payments | Manage your inventory by Locations Download: Product Stock Inventory Report | List of Customers to be serviced as per Warranty |

| Block Stocks for each Customer's Order | No eMails for Materials Request. All are in Purchase REQUEST form. | Manage Batch Productions | Alternate Units of Measurements | Complete the Services and give FREE items and Invoice Customers. |

| Manage Export with Packing Lists, Customs List etc You can have Each Customer wise PRICE LISTS that works automatically. | Purchase Register with 100% stock tracking. Download: Purchase Register Report | Project Based Production with stock block features. Download: FG Report with Scrap & Reject Details | We don't allow -ve Stocks. If NO Stocks, NO ISSUE | Manage below cases 1. Customer rework and Repairs 2. Customer Warranties |

| Real time Customer Outstanding and other Financial Reports. Download: Customer Statement | Track Materials request from Indents to PO to GRN | 100% Tracking of Customer Sent Materials 1. Make Inward DC and track RM sent by Customers 2. Convert and send FG 3. Link DC to Invoice and collect Money | User Access Based LOCATION Controls You can also decide what Transactions to happen at each Location. At "SCRAP" location, you don't ISSUE materials to PRODUCTION. | Identify the Parts used in "Services". |

| Connect Sales Order to Work Order - Track Production Status for each Customer Orders. | Vendor Rating Reports based on multiple factors Download: Sample Vendor Rating | "Nesting" feature with tracking of BURNOUTs, END Bit pieces. | ABC - Activity Based Costing | Ability to Control / Limits items to be issued to Service Department. |

| Create Delivery Challan and convert it to a REAL INVOICE | Send Supplier Statement in 5 Seconds. | 100% tracking of WIP items with accurate Unit Costs Now you can find your TRUE FG Costs | Location wise Inventory Stock reports / Product Transaction report helps to trace the Materials state. |