Small and Medium Manufacturers has to streamline their Business Financial Ratios to Analyse, unlock Actionable insights, and make informed decisions to drive success. These ratios helps in the business to monitor and control the Financial aspects. In this article, we explore the significance of Business financial ratios, their advantages, and how a Cloud ERP software can empower your business to harness their potential.

What is a Business Financial Ratio?

Business Financial ratios are quantitative indicators that help evaluate a company’s financial performance, stability, and profitability. These Business financial ratios are derived from the company’s financial statements and provide valuable insights into its financial health.

What is the meaning of Business Financial Ratios?

Financial ratios are calculated by comparing specific financial data from a company’s financial statements, such as the balance sheet, income statement, and cash flow statement. They help measure various aspects, including liquidity, solvency, profitability, and efficiency.

Which are the key Business Financial Ratios we should focus?

There are many Financial ratios that are used in the business community, but we dont need to focus on all as these may not help. Lets focus on what we need to look and use them to take advantages.

- Liquidity Ratios: These ratios assess a company’s ability to meet short-term obligations and measure its liquidity. Examples include the current ratio and the quick ratio.

- Solvency Ratios: Solvency ratios evaluate a company’s long-term financial stability and its ability to meet long-term obligations. The debt-to-equity ratio and interest coverage ratio are common solvency ratios.

- Profitability Ratios: These ratios measure a company’s profitability and its ability to generate profits relative to its revenue, assets, or equity. Examples include gross profit margin, net profit margin, and return on investment (ROI).

- Efficiency Ratios: Efficiency ratios evaluate a company’s operational efficiency and how effectively it utilizes its assets and resources. Inventory turnover ratio and accounts receivable turnover ratio are examples of efficiency ratios.

Business Financial Ratios and Their Advantages:

Financial ratios offer several advantages for businesses, including:

- Performance Evaluation: Financial ratios provide a comprehensive view of a company’s performance, allowing for benchmarking against industry standards and identifying areas for improvement.

- Decision-Making: Financial ratios aid in informed decision-making, helping businesses evaluate investment opportunities, assess growth potential, and allocate resources effectively.

- Financial Health Assessment: Ratios help gauge a company’s financial health, identify potential risks, and assess its ability to weather economic downturns or market fluctuations.

- Investor Confidence: Strong financial ratios instill confidence in investors, lenders, and stakeholders, enhancing the company’s reputation and attracting potential partnerships or investments.

Which are the Key Business Financial Ratios Focus to Improve?

Below are the few of the major financial ratios that we can focus on.

a) Current Ratio: Measures a company’s short-term liquidity by comparing its current assets to its current liabilities.

b) Debt-to-Equity Ratio: Assesses a company’s financial leverage by comparing its total debt to its shareholders’ equity.

c) Gross Profit Margin: Evaluates a company’s profitability by measuring the percentage of revenue retained after deducting the cost of goods sold.

d) Return on Investment (ROI): Measures the return generated on investments made in the company.

e) Inventory Turnover Ratio: Assesses how quickly a company sells its inventory over a specific period.

To understand additional important Financial RATIOS, click here and see how ACTouch ERP helps your Manufacturing Companies.

FAQs on Business Financial Ratios:

- How can Business financial ratios help my business?

Answer – Financial ratios provide valuable insights into your business’s financial health, performance, and profitability. They help you assess liquidity, solvency, profitability, and efficiency, enabling informed decision-making and identifying areas for improvement.

2. What are the key financial ratios that businesses should monitor?

Answer – Key financial ratios include liquidity ratios (e.g., current ratio), solvency ratios (e.g., debt-to-equity ratio), profitability ratios (e.g., gross profit margin), and efficiency ratios (e.g., inventory turnover ratio). Monitoring these ratios provides a comprehensive view of your business’s financial performance.

3. How can SaaS Cloud ERP Software enhance financial ratio analysis?

Answer – SaaS Cloud ERP Software automates data collection, streamlines financial statement analysis, and generates real-time reports with accurate financial ratios. It eliminates manual calculations, improves data accuracy, and enables efficient monitoring of financial health.

4. Can SaaS Cloud ERP Software integrate with existing financial systems?

Answer- Yes, our SaaS Cloud ERP Software is designed to integrate seamlessly with existing financial systems, such as accounting software. It facilitates smooth data transfer, eliminates duplication of efforts, and ensures data consistency.

5. How does SaaS Cloud ERP Software contribute to financial decision-making?

Answer- SaaS Cloud ERP Software provides real-time financial insights, robust reporting capabilities, and forecasting tools. It enables you to make data-driven decisions, evaluate investment opportunities, and allocate resources effectively, maximizing your financial performance.

6. Is SaaS Cloud ERP Software suitable for small businesses?

Answer- Absolutely! SaaS Cloud ERP Software is scalable and caters to businesses of all sizes, including small businesses. It offers cost-effective solutions, eliminates the need for infrastructure investment, and provides access to advanced financial analysis tools.

7. Can SaaS Cloud ERP Software help with financial compliance?

Answer- Yes, SaaS Cloud ERP Software ensures financial compliance by automating processes, enforcing internal controls, and generating accurate financial reports. It helps businesses adhere to regulatory requirements and facilitates audit readiness.

8. How can financial ratio analysis help attract investors?

Answer- Strong financial ratios demonstrate a company’s financial health, stability, and growth potential. Investors rely on these ratios to assess investment opportunities. By using SaaS Cloud ERP Software to improve financial ratio analysis, you can instill investor confidence and attract potential investors.

9. Can SaaS Cloud ERP Software help identify financial risks?

Answer- Yes, SaaS Cloud ERP Software provides real-time monitoring and alerts for potential financial risks. By analyzing financial ratios regularly, businesses can proactively identify risks, such as liquidity issues or excessive debt, and take corrective measures.

10. How can I get started with SaaS Cloud ERP Software for Financial ratio analysis?

Answer- Getting started is easy! Contact our team to discuss your business’s requirements and explore how our SaaS Cloud ERP Software can help streamline your financial ratio analysis. Our experts will guide you through the implementation process and ensure a smooth transition.

Remember, leveraging financial ratios and utilizing SaaS Cloud ERP Software can be transformative for your business. Embrace this powerful combination to make informed decisions, drive financial growth, and stay ahead in the competitive business landscape.

Business Financial Ratios serve as valuable tools for businesses to evaluate their financial performance, make informed decisions, and drive success. Our ACTouch Cloud ERP Software empowers businesses to streamline their Business Financial Ratio analysis, providing real-time insights and actionable data. Unlock the benefits of financial ratios and harness the power of our ERP software to propel your business forward in the dynamic Indian market.

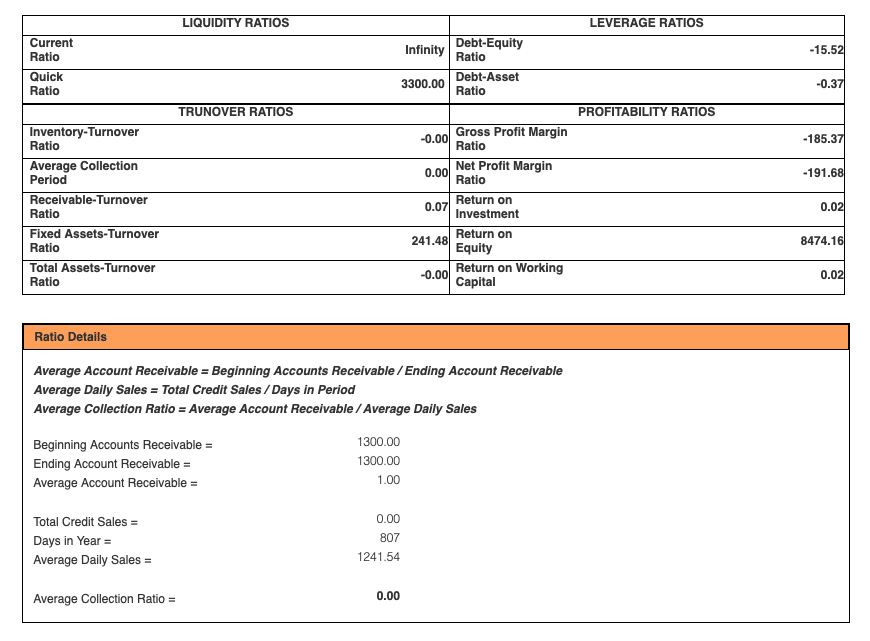

ACTouch ERP’s sample Business Financial Ratios reports looks as below.

In Summary ACTouch Cloud ERP Software has complete monitoring feature to manage and run your business.