What is Purchase receipt? What is Goods Receipt Notes (GRN)?

What is Purchase Receipt? How a Purchase Receipt document helps a manufacturing companies? In few business scenarios, where businesses would call the Suppler / Vendor to supply the materials immediately. In these cases, the company will not send a Purchase Orders to requesting the supply of materials. We create a new Purchase Receipt document without any Purchase Order reference (Direct POR) as we need to bring in the stock into Inventory with this process. This is a common process in many companies and its easy too.

This is an important process where a Purchase Receipt is made without a PO. However the screen layout is same as that of Purchase Order inventory module and no changes.

Important on Purchase Receipt – When you receive the materials, following process completes. So be careful.

- Inventory / Stock comes into ERP / Company. So your stock is available for any next process.

- Average cost of the Inventory changes due to NEW STOCK and its UNIT Purchase Price. We follow weighted average costing of Inventory based on old stock and new stock thats received.

- Supplier Payments amount is updated

- Taxes are shown with how much you paid to Supplier. (Actual Supplier Payments happens at later date). Here the liability is created.

- POR Document can be used for the next payments or Purchase Returns, if the received quantity is wrong.

Basic Data settings to complete before you begin this operations.

Please complete the basic data settings to before start the operations. Few of these data are shown on the screen based on the settings done in Purchase Settings

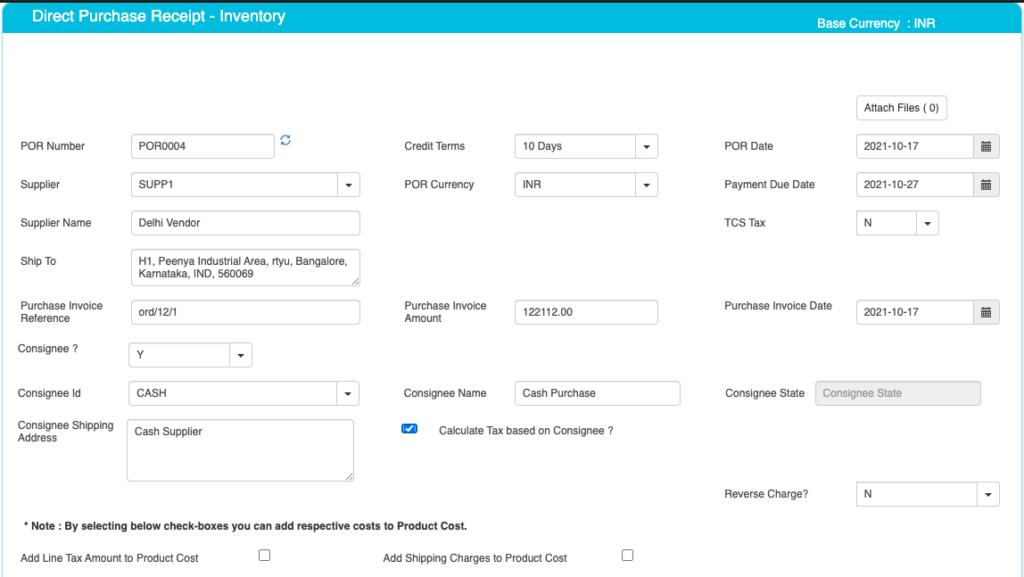

Direct Purchase Receipt / Goods Receipt Notes (GRN)- Master data entry Screen

Please enter the POR No, Supplier ID and his details. Transaction date is important for these transactions to show in BS or PL reports.

Direct POR – Master screen fields are as below.

| Field ID | Field Name | Mandatory? | Field Description and how it helps? |

|---|---|---|---|

| Site ID | Branch Name | No | If you are using Multiple Branches feature then this FIELD appears. Multi Branch / Sites is a feature that can help to make separate document for each SITE / Branches. |

| POR Number | Purchase Receipt No / GRN No. | Yes | This is the Purchase Receipt / GRN number, a unique number to recognize the document. This is either auto generatedManually you can create. |

| Credit terms | Credit Period | No | Select the Credit terms from the Dropdown. |

| POR Date | POR creation Date | Yes | Effective Date of transaction |

| POR Currency | Currency of Document | Yes | It is the currency used for POR / for Transactions. This is also called “Document Currency”. |

| Due Date | Payment due date | Yes | This is the date by which the payment has to be made. |

| Supplier ID | Supplier ID | Yes | It is a unique identification number given to each Supplier in ACTouch ERP |

| Supplier Name | Supplier / Party Name | Yes | Supplier Name / Business name. |

| Ship To | Shipping Address | Yes | This is the address of Company, where the particular product has to be delivered to. |

| GST Number / TAX ID | Supplier Tax ID | No | This gives Supplier TAX NO. It’s a unique ID necessary for businesses. |

| PAN Number | Permanent Account Number | No | This is the Permanent Account Number of the individual / Business. |

| Receive material now | Material to be Received | Optional Default Value = N | This tells us whether these Products to be Received immediately or later on some date. This creates GRN immediately. |

| Reverse Tax | Tax | Default value = N | If the taxes are withheld and is NOT paid to the SUPPLIER, then set this value to “YES”. |

| TCS Tax | Tax Collected at Source Amount | Default value = N | Enable the feature, if you need it. This is the tax payable by a seller, which he collects from the buyer at the time of sale. |

| Order reference | Order number | No | This is Order Number (for reference) |

| Order Amount | Order amount | No | This is the total amount of the Order (for reference) |

| Order Date | Order date | No | This is the Order Date (for reference) |

| Add Line Tax Amount to Product Cost | Tax Amount is added to product costs | Default value = No | Add Line Tax Amount to Product Cost This is part of the Product Landing cost where we can add the TAX Amount Back to Product cost. |

| Add Shipping Charges to Product Cost | Shipping Charges to Product cost. | Default value = No | Add Shipping Charges to Product Cost This is part of the Product Landing cost where we add Shipping Charges to Product cost. |

Direct Purchase Receipt / POR / GRN – Consignee Details. Use if, you need them.

| Field ID | Field Name | Mandatory? | Field Description and how it helps? |

|---|---|---|---|

| Consignee | Consignee | By Default = NO | This is the Recipient of the Goods that are shipped. It tells whether we have a Consignee or not? |

| Consignee Id | Consignee ID | Yes | This is mandatory, if you enable “Consignee = Yes” This is the identification number given to a consignee. |

| Consignee Name | Name of the Consignee | Yes | Consignee Name / Business Name. |

| Consignee State | Consignee State | Yes | Consignee State and its important for Indian GST purpose. |

| Consignee Shipping Address | Shipping address of Consignee | Yes | Address of the shipment receiver (Consignee). |

| Calculate Tax based on Consignee | Tax on Consignee | By Default = NO | This tells whether to apply the tax on the Consignee or not. |

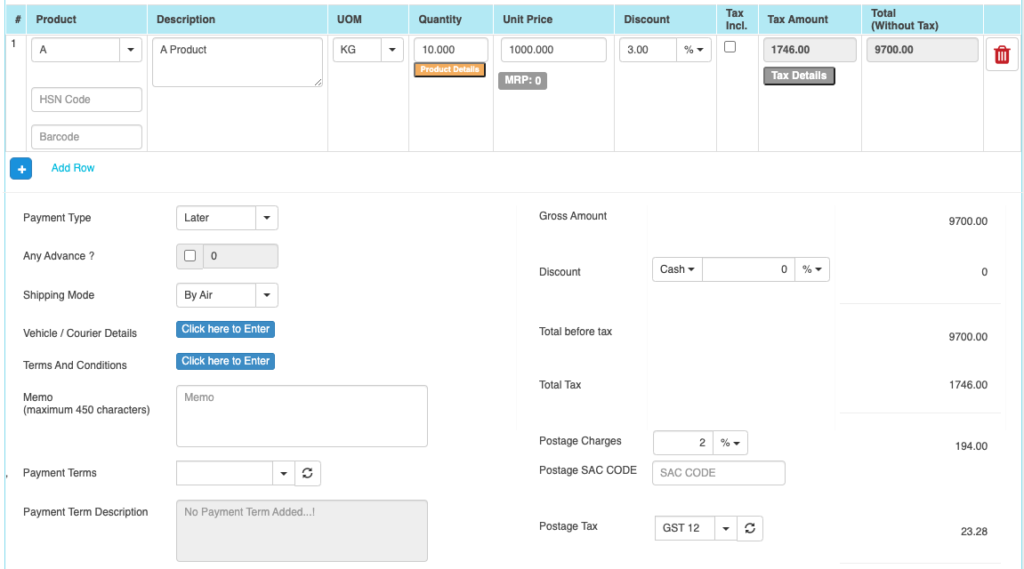

Direct POR / GRN- Enter the Product Line details like Product Descriptions, Quantities, Unit Price etc.

Direct POR – Enter the Product line Details

| Field ID | Field Name | Mandatory? | Field Description and how it helps? |

|---|---|---|---|

| Product Group, Subgroup1, Subgroup2, Subgroup3. | Product Group, Subgroup1, Subgroup2, Subgroup3 drop down values. | NO | These are the data helps to select the right PRODUCT for the line item. These data appears on the screen, if you enable “Product Group = Yes” in the “Purchase Settings”. |

| Product ID | Product ID | Yes | Select Product ID for Purchase. |

| Product Description | Product Description | Yes | It is the description about the product. |

| UOM | Unit Of Measure | Yes | Unit of Measurement of the Product. If you have an Alternate UOM, then select the same here for the Product that you are selling. |

| Quantity | Purchase Quantity | Yes | This is the Purchase quantity |

| Unit Price | Unit Price | Yes | It is the Unit price of the product. |

| Discount | Discount on LINE level | No | Apply the PRODUCT level DISCOUNT for the Supplier, if any. |

| Tax incl. | Inclusive of Tax | Default = No | Tax include – Yes or No. This feature is used for the MRP types of Products where the TAX is ADDED with UNIT price. So we should show the Basic Product Amount + Taxes Separately. |

| Tax amount | Tax Amount | No | Please select the TAX CODES that are RIGHT for the PRODUCT. If you have setup these data in Product Master, then ERP will pick from there directly. |

| Total | Total Amount | Yes | This is the Total amount of the line item excluding TAX AMOUNT |

| HSN Code | HSN Codes | No | HSN Codes for the Product that are provided by Government. |

| Bar Codes | Bar code No | No | Bar codes helps to pick the items from master. |

| Receipt Due date | Date when the materials to be recd. | No | This is LINE specific DUE Date for the item to be RECD. |

Other Master data and it’s parameters

Enter the parameters based on your needs

| Field ID | Field Name | Mandatory? | Field Description and how it helps? |

|---|---|---|---|

| Payment Type | Payment (Now or later) | By default – “LATER” | It describes whether the payment will be made immediately or at a later stage. Based on the same, a Financial Voucher is made. |

| Terms And Conditions | Business Terms And conditions | No | It’s the General Terms and Conditions for the Delivery etc. If you can also make templates and use it. |

| Ship Mode | Transport mode | No | This describes us about the type of transport for delivery. It may be by Air, Cargo, etc. |

| eWay Bill No | eWay Bill No | No | If you are shipping the items, then you can enter the eWay Bill no that’s generated by Indian Govt Portal. |

| eWay Bill Date | eWay bill Date | No | Date of the eWay Bill specific to Indian Govt |

| Memo | Additional information | No | You can add more Information about the Purchase Order. |

| Payment terms | Payment terms | No | These give us the details about payment terms between the two Parties that they have agreed on. You can define multiple “Payment Terms” in Master and use them. |

| Payment Terms Description | Payment Terms | No | This is description of Payment terms. |

| Sub Total | Total price | Yes | Subtotal of the Order. |

| GROSS / Cash Discount | Discount on the total Payment | No | It’s the Overall discount on the Order. Two types Cash Discount – You can give the Discount in “Amount” only.Trade Discount – You can give either in “%age“ or in “AMOUNT” |

| Total before tax | Amount before tax | Yes | It’s the Total amount without Tax amount |

| Total tax | Tax amount | Yes | It’s the total Tax on the line items. |

| Round off | Rounded off amount | No | Enter the Amount, if you want to change it. Its small amount that can be added or removed from the TOTAL AMOUNT to round-off. |

| Total | Total Amount of the Order | Yes | This is the total Order amount after rounding off. |

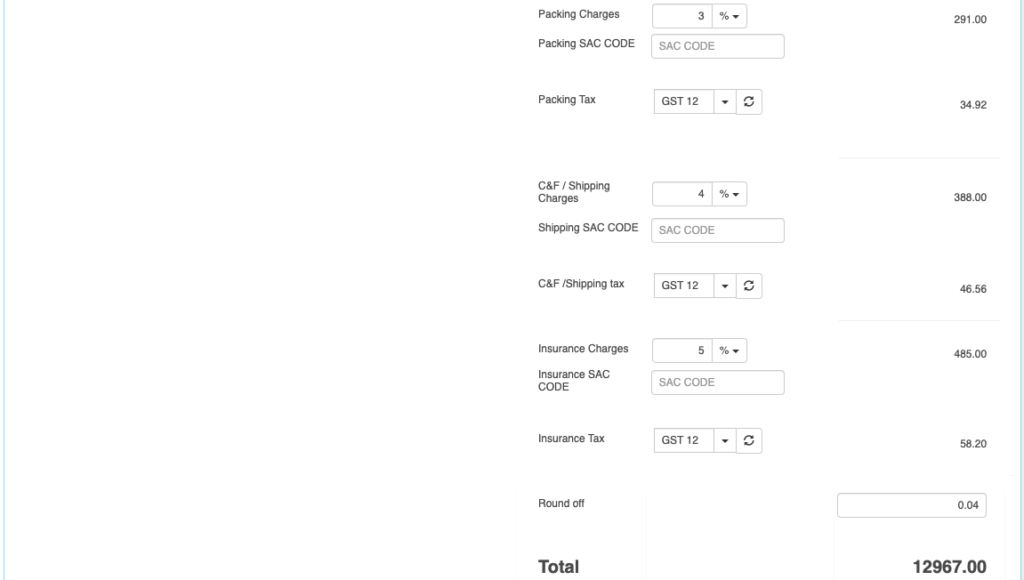

The below Charges data are shown based on the “Purchase Settings” and enable the charges that you need.

| Field ID | Field Name | Mandatory? | Field Description and how it helps? |

|---|---|---|---|

| Field ID | Field Name | ||

| Postage Charges | Postage Amount, if any | No | Enter the Amount, if you need it. (Other charges for Order). Enter the Postage charges that will be billed to the Buyer, if any. |

| Postage SAC CODE | SAC Code | No | Enter the SAC Code, if you need it. |

| Postage Tax | Postage Tax | No | Select the Taxes, if you need it. This gives the tax levied for postage.it comes under different GST slabs for the type of product. |

| Packing Charges | Packing Charges, if any | No | Enter the Amount, if you need it. (Other charges for Order). This is the Charges for the product that’s billed to the buyer, if any |

| Packing SAC CODE | SAC CODE | No | Enter the SAC Code, if you need it. |

| Packing Tax | Tax for the Charges | No | Select the Taxes, if you need it. This gives the total TAX on transport cost of the product. |

| Shipping Charges | Shipping Charges, if any | No | Enter the Amount, if you need it. (Other charges for Order). This is the Shipping Charges for the product that’s billed to the buyer, if any |

| Shipping SAC CODE | Shipping SAC CODE | No | Enter the SAC Code, if you need it. |

| Shipping Tax | Tax for the Charges | No | Select the Taxes, if you need it. This gives the total TAX on transport cost of the product. |

| Insurance Charges | Insurance Amount, if any | No | Enter the Amount, if you need it. (Other charges for Order) Enter the Insurance amount for the product to be delivered, if any |

| Insurance SAC CODE | Insurance SAC CODE | No | Enter the SAC Code, if you need it. |

| Insurance Tax | Tax for the Charges | No | Select the Taxes, if you need it. This gives the total TAX on the freight insurance amount. |

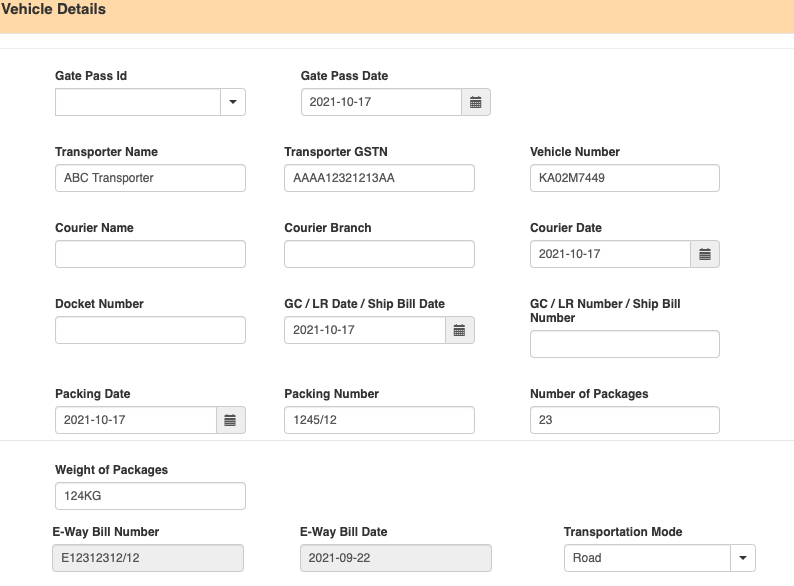

Enter Vehicle / Courier Details = Yes.

Enter vehicles details to manage the Purchase Receipt with a record to identify the vehicle against which the materials are sent.

Most of these data are entered for recording purpose.

| Field ID | Field Name | Mandatory? | Field Description and how it helps? |

|---|---|---|---|

| Field Description and how it helps? | |||

| Vehicle / Courier details | Vehicle /courier details | No | Enter Vehicle / Courier details like Transporter Name / Courier name, vehicle number, etc. |

| Gate pass Id | Gate Pass Voucher ID | No | This is the GATE Pass no that’s created in GATEPASS Module in ACTouch ERP. This helps to connect the GATE PASS Entry to the Invoice / GRN data. |

| Gate pass Date | Gate Pass Date | No | Date of Gate Pass entry in ERP |

| Transporter Name | Transporter Name | No | Transporter Name / person Name |

| Transporter GSTN | Transporter Tax ID | No | TAX NO. It’s a unique ID necessary for businesses. |

| Vehicle No. | Transporter Vehicle Number | No | Enter Transporter Vehicle Number. |

| Courier Name | Courier Agency Name | No | Courier Agency Name responsible for delivering the product to the Supplier or businesses. |

| Courier Branch | Courier Branch Name | No | Courier Agencies Branch |

| Courier Date | Date of product dispatch | No | Dispatch Date. |

| Docket Number | Doc No | No | Docket Number |

| GC / LR Date / Ship Bill Date | Receipt of the lorry | No | It is the Date of Receipt LR No etc that’s received from the transporter. |

| GC / LR Number / Ship Bill Number | Lorry receipt number | No | This gives the lorry receipt from the transporting company. |

| Packing Date | Date of package | No | Date the product was packaged. |

| Packing Number | Package number | No | Package no for reference. |

| Number of Packages | Total number of package | No | Total number of packages that’s delivered |

| Weight of Packages | Total weight of the packages | No | Total weight of the packages. |