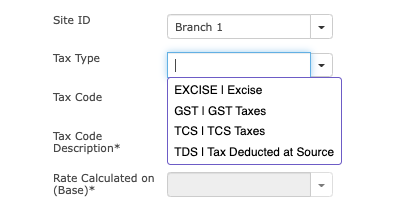

Tax Master module helps you to define different new Tax Codes based on your Country and the specific tax needs. ACTouch ERP is flexible enough to define and add new taxes based on your needs.

Based on the “General Settings” and the Company BASE Country, the Taxes would be appearing in the Master.

- GST Taxes (Only for Indian Type of taxes)

- VAT Taxes (Service Taxes for Rest of the world)

- TDS

- TCS

- Customs / Excise

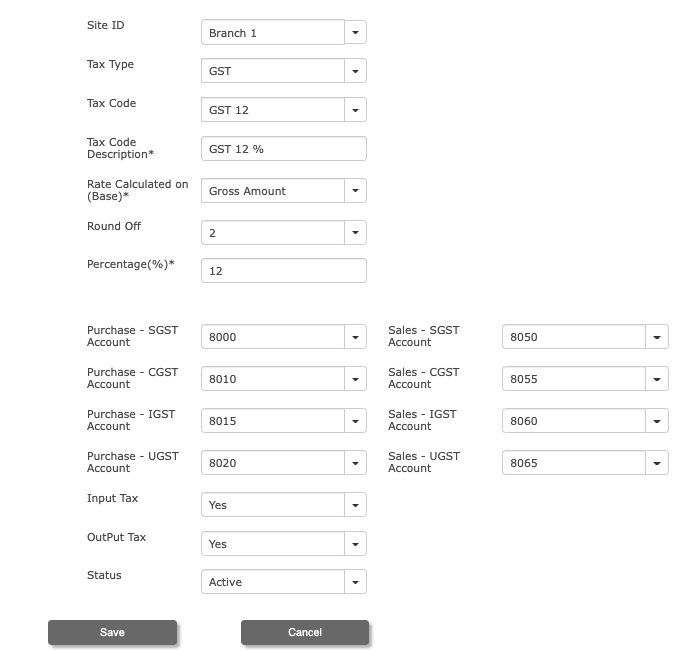

Tax Master – Sample Tax filled data is as below.

GST Taxes – It needs additional information to file the returns.

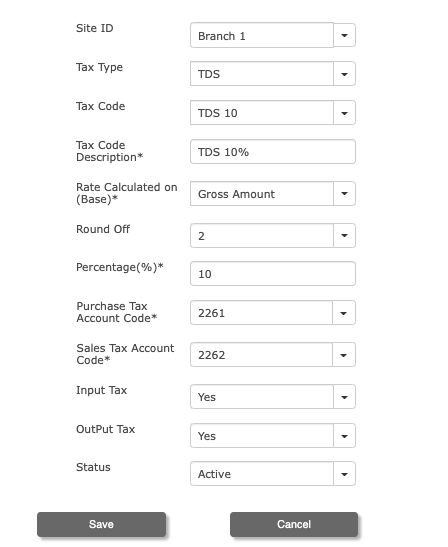

Tax Master: TDS Taxes and how to set its master

Special Cases / Process of Tax Collections – Special case to handle TAX on TAX type of cases

One of the Best features of ACTouch is the “Tax on Taxes”.

Few business cases, where Govt collects the taxes on the BASIS of another TAX amount. For example “CESS” is a type of TAX Collected on the basis of another tax amount. In Indian tax context, we do have different taxes that need to be handled by the ERP Software.

- Cess Amount – Its normally calculated on the BASE TAX Amount. For example – A CESS 2% on the GST 18% Taxes.

- Here we you need to go to TAX MASTER and create a new TAX CODE as “CESS 5”.

- Now in the “BASED ON TAX” section – select “GST 18%”.

Let’s say, the GST 18% amount is Rs 1000.00. Now the “CESS 5” will collect 5% on Rs 1000. Means its Rs 50.00 to be collected.

In Summary, the total tax amount thats collected is Rs 1050.00.

TCS – Tax Collected at Source – TCS is calculated on TOTAL AMOUNT of OTHER CHARGEs too.

In India, we have the TCS (TAX Collected at Source) and this is to be COLLECTED as part of TOTAL SALES PROCEEDS thats received. Means at the time of RECEIVING the FINAL PAYMENT from CUSTOMER.

Technically a INVOICE will have multiple items like Sales AMOUNTs, TAXES, Other Shipment and Incidental Charges, Taxes on them etc. So the TCS to be CALCULATED on this TOTAL AMOUNT.

These setups are DONE in PURCHASE and SALES SETTINGs.

Means, in addition to creating the TAX CODES, you also need to ENABLE these FEATURES in these SETTINGS