From 1 Aug 2023 onwards, Indian GST Council has informed the Businesses whose turnover is > Rs 5 Cr to make eInvoice and submit at government eInvoice Portal. So the questions to answer are “how to generate eInvoice?”, “Why we should make an e Invoice?”, “How it helps the business?” etc

2 methods to “Generate eInvoice”

- Make it in offline process – Create a regular invoice and then download these data into an upload able format into eInvoice portal – https://einvoice1.gst.gov.in

- Use the Cloud ERP Software and upload the Invoice to generate the IRN No from eInvoice portal.

Common type of Errors faced when you generate eInvoice

When generating eInvoices, various errors can occur, leading to discrepancies and potential issues in the invoicing process. Some common eInvoice errors include and many can be avoided by using an ERP software.

- Incorrect Data Entry: Inputting incorrect information, such as incorrect product codes, quantities, pricing, or tax rates, can result in inaccurate eInvoices. For example missing HSN Codes, Units of Measurement etc. Product Description should be less than 50 characters.

- Missing or Incomplete Information: Omitting essential details, such as customer information, seller details, invoice number, or dates, can render the eInvoice incomplete or invalid. Please note that Address Field lengths are less than 100 Characters. If the ADDRESS fields lengths are more, then you get an Error and can’t proceed with generating eInvoice.

- Calculation Errors: Errors in calculating the total amounts, subtotals, discounts, or GST taxes can result in incorrect invoice amounts and potential payment discrepancies. Please note GST Taxes amount should be matched properly else eInvoice portal will give an error.

- Format and Structure Issues: Non-compliance with eInvoice format requirements, such as missing mandatory fields or using incompatible file formats, can lead to rejected or unreadable eInvoices.

- Duplicate Invoice numbers: Accidental creation and submission of duplicate invoices can cause confusion, delays in processing, and potential payment issues. If you use an ERP then this error can be avoided

- Currency Conversion Errors: For international transactions, incorrect currency conversions or using outdated exchange rates can lead to inaccuracies in the invoiced amounts. If you use an ERP then this error can be avoided

- Taxation and Legal Compliance Issues: Failure to adhere to tax regulations, such as using incorrect tax codes or rates, can result in non-compliant eInvoices and potential penalties.

- Data Transmission Errors: Issues during the transmission of eInvoices, such as interrupted connections, failed uploads, or data corruption, can cause delays or loss of invoices. Most of the time, if you can’t upload the data, then wait for 5 min and retry again. eInvoice portal would allow.

- Data Validation Failures: Inadequate validation processes can result in accepting erroneous or incomplete data, leading to inaccuracies in the eInvoice.

- Non-Standardized Data Formats: Lack of standardization in eInvoice formats and systems can cause compatibility issues, making it challenging to exchange or process eInvoices smoothly.

To mitigate these errors, it is crucial to implement robust validation processes, ensure accurate data entry, use standardized formats, and employ reliable eInvoice software or systems that support automation and compliance checks. Regular auditing and monitoring can help identify and resolve any errors promptly, ensuring a smooth invoicing process.

One of the major advantages of using an ERP is to avoid the above issues and make sure that the above are avoided.

Please read more about eInvoice, how eInvoice works etc here.

Steps on How to Generate eInvoice in ACTouch?

In ACTouch ERP, you have to make a regular Invoices. Once its done, you have the option to SUBMIT it to eInvoice portal in Online MODE and generate IRN NO, ACKNOWLEDGEMENT NO and ACKNOWLEDGEMENT DATE.

Step1 – Create Invoice in ERP – Its a regular Invoice for an Items or Services.

Step 2- in ONINE MODE, convert these Invoices to eInvoices.

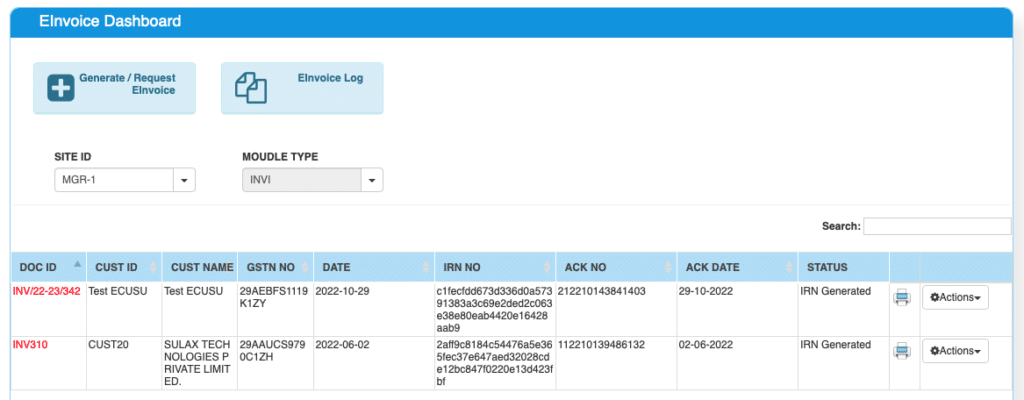

Below is the list of eInvoices that’s already generated. You have an OPTION to CANCEL the eInvoices that’s already generated too.

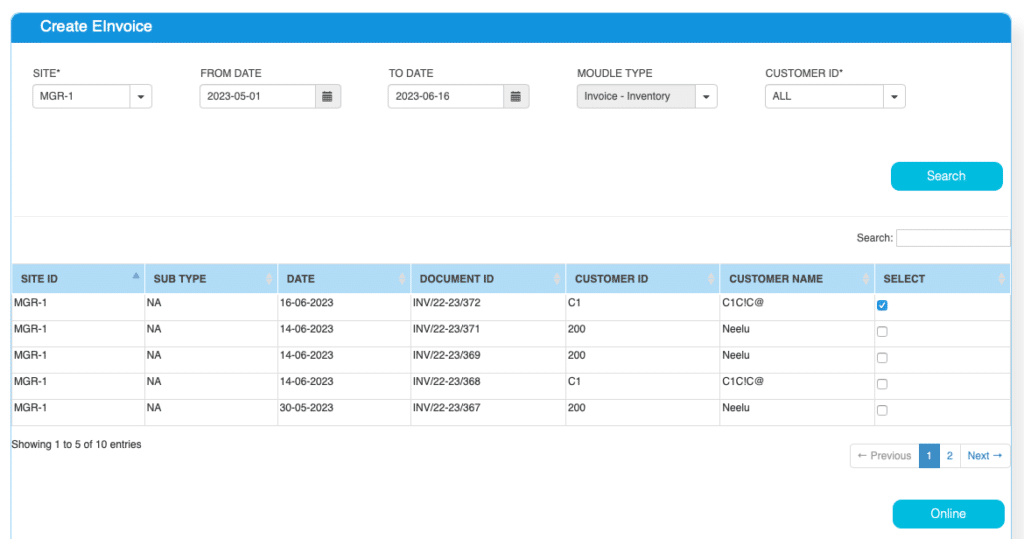

This screen is used to convert Invoices to eInvoices. You get an option to choose

- Single Invoice

- Multiple Invoices

- Decide which Invoices to convert to eInvoice and which shouldn’t be done now.

Once you select the INVOICE and click on “ONLINE”, ERP will validate the data sent to online portal and show errors, if any.

As we said, generating eInvoice in ACTouch ERP is simple and easy.