What is Accounts Payable?

When a Vendor / Supplier supplies the Products or Services, we need to Pay them for the Products / Services that’s provided to us. Accounts Payable module is where we do select vendors invoices / Goods Receipt Notes (POR) the payment to Supplier or Customer depending on the payment status. To simplify the AP process and ensure that Accountant has the visibility of all the details, in ACTouch, we designed the module where we show all the OPEN documents and the amount to pay to Vendors / Suppliers at one go.

Business owners need to focus on the financial health of the company based on the company generated financial statements like balance sheet, Income statement, Accounts Receivable, Cash flow statements, payments to vendors etc.

Accounts payable amount is shown as part of Balance Sheet -> “Current Liabilities” section. Advanced Paid to vendors are also shown in Balance sheet of the company.

When we do the vendor payments, we need to cross check few details as below.

- Accounts Receivable amount to be cross checked in case, we have the same Supplier is also a Customer.

- Payment terms to get any Payment discounts / cash discounts, in case a vendor receives the payment earlier than the invoice due dates.

- Any advance payment or Debit notes or any Credit balance to adjust, Late payments to adjust etc

- As part of agreed payable process / Payment process by the company, it can be initiated based on the cash flow statements and availability of cash to pay the vendor. its important to pay your vendor with timely payments to keep a good relationships with vendors.

A vendor payment can be for supply of raw materials or any import purchase or office supplies or any business purchases or any services rendered by vendor.

These payable records are maintained by doing a journal entry to accounts by keeping manual accounts or ledgers. These are always a double-entry accounting entries. These helps to find duplicate entries, if it’s done and an ability to reverse them and correct them before finalising Balance sheet.

Note – Many of our Customers loved ACTouch Cloud-Based ERP Software’s simple screen for Accounts Payable module as it helps to SEE ALL THE OPEN FINANCIAL DOCUMENTS at ONE menu. Try ACTouch ERP.

In this document, we try to address the below.

- What is Accounts Payable?

- How it helps Business? How an accounting software or an ERP helps business?

- What are the settings to be done to enable this feature and pay money to Vendors / Suppliers?

- What are Accounts Payables Journal Entries? How we can avoid duplicate payments?

Accounts Payable Process Steps

The Accounts Payable (AP) process involves the steps necessary to record of documents by the payable department and pay the company’s outstanding invoices to suppliers or vendors. The typical steps in the accounts payable process include below AP Process.

- Receiving invoices / vendor invoices by the payable department. These Invoice approval is important to proceed.

- Payable team will verify the accuracy and legitimacy to avoid duplicate payments.

- Recording invoices in the Accounting Software.

- As part of payable process, obtain the approvals to pay

- Scheduling payments.

- Making the actual payment to the supplier.

Accounts Payable Invoice Processing

Accounts payable invoice processing refers to the activities involved in handling and managing invoices received from suppliers. This process includes receiving the invoice, reviewing it for accuracy and completeness, matching it with purchase orders and receipts, obtaining necessary approvals, and entering the invoice details into the accounting system for payment processing.

Accounts Payables Journal Entries

Accounts Payable is a liability account that represents the amount a company owes to its creditors and suppliers for goods or services received but not yet paid for. When transactions related to accounts payable occur, journal entries are recorded to reflect these transactions accurately in the accounting system. Below are some examples of journal entries for typical accounts payable transactions:

Purchase of Inventory on Credit

Suppose Company A purchases inventory worth $5,000 on credit from Supplier B. Journal Entry is as below

Db – Inventory (Asset) $5,000

Cr – Accounts Payable (Liability) $5,000

Payment of Accounts Payable

Suppose Company A makes a payment of $2,500 to Supplier B to settle part of the accounts payable balance. Journal Entry as below:

Db Accounts Payable (Liability) $2,500

Cr Cash (or Bank) $2,500

Early Payment Discount:

Suppose Company A receives a discount of $200 for early payment on a $5,000 invoice from Supplier B. Journal Entry as below:

DB. Accounts Payable (Liability) $4,800

Cr. Cash (or Bank) $4,800

Recording Purchase Returns

Suppose Company A returns defective goods worth $1,000 to Supplier B. Journal Entry as below:

DB Accounts Payable (Liability) $1,000

Cr. Purchase Returns (Expense) $1,000

Accruing Unrecorded Expenses

Suppose Company A receives utility services but has not yet received the invoice for $800. Journal Entry as below:

Db. Utilities Expense (Expense) $800

Cr. Accounts Payable (Liability) $800

Reversing an Accrual Entry

Suppose Company A received the utility invoice for $800 and now wants to reverse the previous accrual entry. Journal Entry as below:

Db. Accounts Payable (Liability) $800

Cr. Utilities Expense (Expense) $800

Please note that the specific accounts used in the journal entries may vary depending on the company’s chart of accounts and accounting practices. It is essential to ensure accuracy and consistency while recording accounts payable transactions to maintain reliable financial records.

Accounts Payable Automation Software

Accounts payable automation software refers to specialized software solutions designed to streamline and automate various aspects of the accounts payable process. This software helps in digitizing and automating tasks such as invoice receipt, data extraction, approval workflows, payment processing, and reporting. Accounts payable automation software improves efficiency, reduces manual errors, enhances visibility, and enables better control over the entire accounts payable process.

ACTouch Cloud ERP helps to manage the Supplier Payments and manages it with Goods Receipt Notes or Supplier Invoices. It tracks end to end payment cycle with vendor ledgers.

Accounts Payable Management System

An accounts payable management system refers to a software solution or platform designed to centralize and streamline the management of accounts payable processes. It encompasses various functionalities, such as invoice processing, payment scheduling, vendor management, financial reporting, and analytics. An accounts payable management system helps businesses effectively manage their payables, improve efficiency, enhance visibility into financial operations, and ensure compliance with internal controls and regulatory requirements.

Accounts Payable Audit Requirements

Accounts payable audit requirements pertain to the procedures and documentation necessary for conducting an audit of the accounts payable function. These requirements typically include maintaining proper records of invoices, receipts, approvals, and payments, ensuring compliance with accounting standards and internal controls, providing supporting documentation for transactions, and facilitating access to relevant information during the audit process.

Mandatory Settings before using Accounts Payable Module.

- General Settings – Enable the Accounts Payable module sequence numbering. If you want a document serial number as “AP0001”, then setup to be done here.

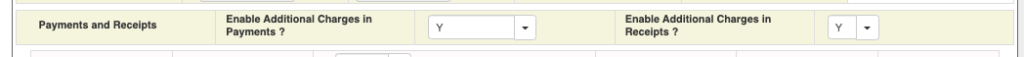

- If you need to book any additional charges, then enable the feature in “General Settings”. So that you can add the charges like Bank Charges for clearing the cheques etc

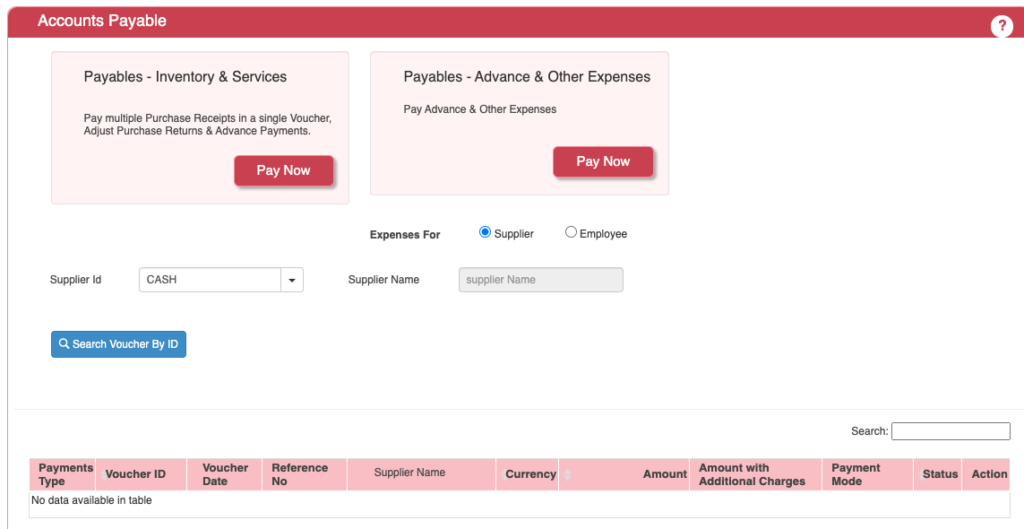

Accounts Payable Dashboard

When you click on the “Payable” link on the application home page, the application would display the following dashboard.

Here you can do the following operations.

- Pay the money against the POR / GRN etc.

- Pay Advance money to Vendor

- Book the expenses like Rent payments, Utility bills payment etc (Payables – Advance and Other Expenses)

- We built another feature for large traders, who can book a Single payment paid to Suppliers and application will internally adjust the GRNs, Advance Paid, Db/Cr notes etc based on the Transaction Dates (FIFO model)

ACTouch ERP helps to take all the above documents into consideration and settle the Final Amount to Supplier / Vendor. If you have any Bank charges or any payments to be adjusted then it can be done here.

We can also use this Accounts Payable Menu to do the payment to Employees too

AP Module – Main Process

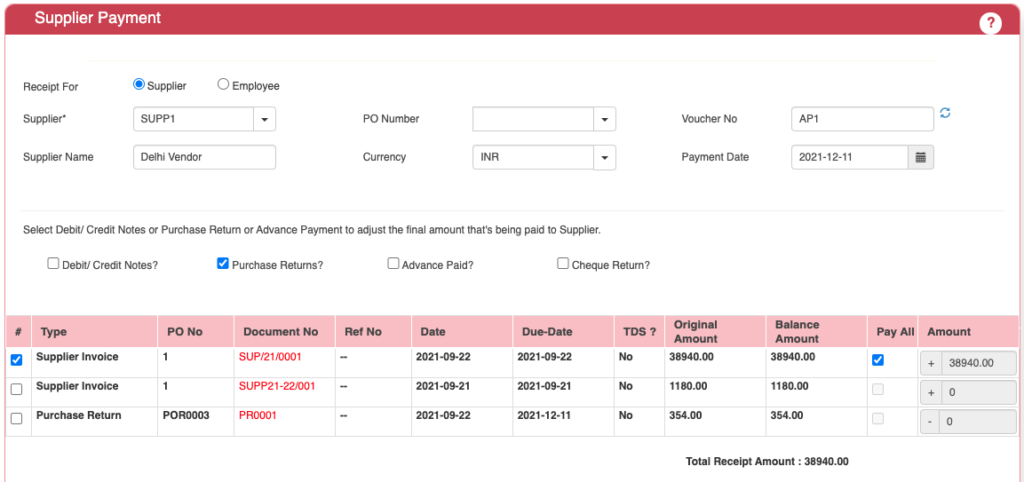

Following documents can be consolidated for a Single Voucher to Pay the money.

- Purchase Receipts document / GRN – This helps us to pay to supplier based on what we received and not against the supplier invoices.

- Advance Payment – Adjust the advances that’s paid to supplier.

- Purchase Returns – Purchase returns helps to track the money to be adjusted for a supplier and at the same time, helps to manage the Inventory

- DB / Credit notes

- Any Cheque Bounces cases to adjust.

- Supplier Invoices against which the payment is made.

Important Note – In case you have a SUPPLIER, who is also a Customer then we show the Customer invoices, Advance received etc in the Account Payables Menu. The advantages of this is, we can do a NET PAYMENT to our Supplier, after deducting what we are supposed to receive from him. Its a good and simple process to display all data at one place.

Field Details.

| No | Field ID | Field name | Mandatory | Field description and how it helps? |

| 1. | Site ID | Branch ID | Yes | It gives the branch from where the Payment Voucher is generated. |

| 3. | Supplier ID | Supplier ID | Yes | Supplier / vendor to whom the payment is made. |

| 4. | Supplier name | Name of the Supplier | Yes | Supplier Name |

| 5. | PO Number | Purchase Order Number | Yes | It is a unique number assigned to a Purchase Order. |

| 6. | Currency | Currency | Yes | Document currency, in which the voucher is made. |

| 7. | Voucher No | Voucher ID | Yes | This is a Document sequence that could be manually entered or Automatically generated by ERP. |

| 8. | Payment Date | Date of Payment Made | Yes | It gives the date on which the payment is made to vendor. |

| 9. | Debit/credit Notes | Debit /Credit Documents | No | You have an option to choose any DB/CR notes that are raised to this vendor to consolidate as part of final vendor settlement. |

| 10. | Purchase Returns | Merchandise/product returned | No | Purchase return happens when a buyer returns the merchandise/product that it had purchased from the seller. |

| 11. | Advance Paid | Amount paid in advance | No | It is the amount paid in advance for merchandise by the buyer to the seller. |

| 12. | Cheque Return? | Cheque Return | Yes | You have an option to choose any adjustments to the cheques returns and claim that money from Supplier. |

| 13. | Type | Type of Business Transaction | Yes | This gives the type of business transaction between 2 parties. |

| 14. | PO No | Purchase Order Number | Yes | It is a unique number assigned to a Purchase Order. |

| 15. | Document No | Document Number | No | It is a unique number assigned to the particular type of business transactions that’s already done. The business transaction may be related to purchase or sales. |

| 16. | Ref No | No | It is the reference number generated to reference any business transaction to its type. | |

| 17. | Date | Business transaction Date | Yes | It is the date on which the particular business transaction was made. |

| 18. | Due Date | Payment Due Date | Yes | It is the date by which the payment has to be made. |

| 19. | TDS? | Tax Deduction at Source | Yes | It says if the TDS was deducted or not by the buyer on the payment made to the supplier. |

| 20. | Original Amount | Amount to be paid to the supplier | Yes | It gives the total Amount that’s to be paid to vendor. |

| 21. | Balance Amount | Amount pending to pay | Yes | It gives the total amount not paid by the buyer from the original amount. |

| 22. | Pay All | Pay the full amount | Yes | It gives an option for the buyer to pay the entire amount of the product or merchandise. |

| 23. | Amount | Amount intended to pay to vendor | Yes | It gives the total amount of money the Buyer intends to pay from the original total amount to be paid to the Supplier. |

| 24. | Total Receipt Amount | Total amount on the Receipt | Yes | It gives the total amount paid by the buyer. |

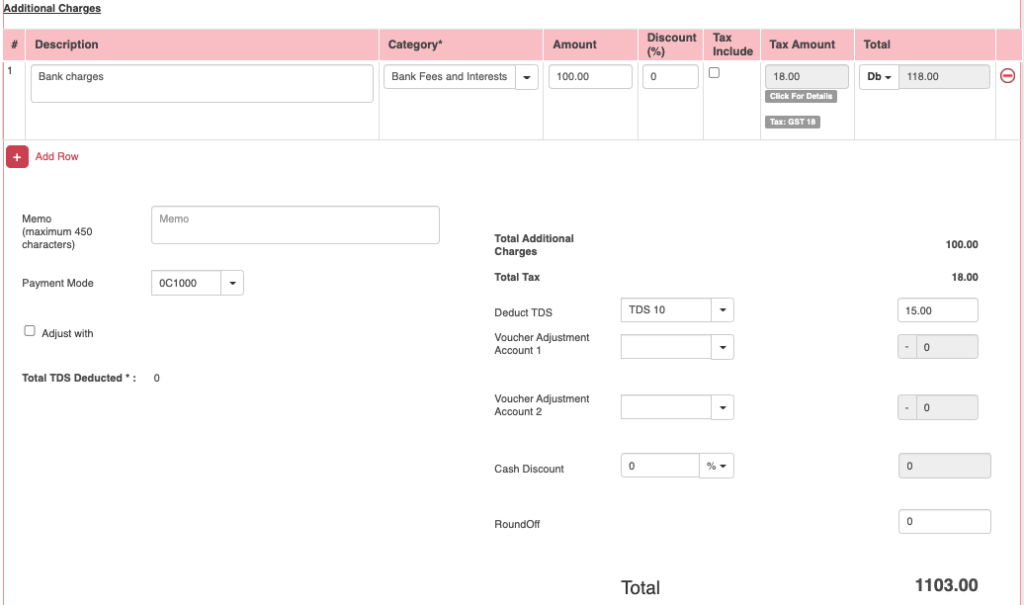

Accounts Payable Module – Bank charges etc. can be added to total payment amount.

Select the CATEGORY and add the Charges. Banks do charge TAXES and select the types of taxes to apply. This can be taken as “Input credit” from government.

In case of any adjustment to be made like outstation cheque charges etc to be paid to bank etc.

| 25. | Description | Description of the payment | Yes | It describes the particular payment details and details about the customer. |

| 26. | Category | Customer category | Yes | It tells us to which category the particular customer or the buyer belongs. |

| 27. | Amount | Amount to be paid by the buyer | Yes | It gives the amount to be paid by the buyer for the particular business transaction. |

| 28. | Discount (%) | Discount provided by the Supplier | Yes | It gives how much % of discount is being provided to the buyer on the total Purchase amount. |

| 29. | Tax Include | Tax Included in the amount | Yes | It gives the tax percentage to be included on the amount. |

| 30. | Tax Amount | Amount of tax paid by the buyer | Yes | It gives the total tax amount to be paid on the merchandise bought by the Buyer. |

| 31. | Total | It gives the total amount paid after including tax amount | Yes | It provides the total amount paid by the buyer after discount and inclusion of Tax Amount. |

| 32. | Memo | Additional Details | Yes | It provides any description about the transaction made or any additional details that need to be mentioned. |

| 33. | Payment Mode | Mode of payment | Yes | This gives the mode of payment. It can be like payment through cash or Bank Account etc.it gives the drop down bar to choose the payment mode. |

| 34. | Adjust with | Adjustment accounts. | No | Any type of account can be chosen to pay the amount. |

| 35. | Total TDS Deducted | Tax Deducted at Source | No | This gives the total TDS deducted till now. |

| 36. | Total Additional Charges | Miscellaneous charges | Yes | This gives the total miscellaneous charges like bank charges etc. |

| 37. | Total Tax | Total Tax Amount | Yes | This gives the total tax amount for the merchandise bought. |

| 38. | Deduct TDS | TDS Deducted | No | This gives an option under which TDS amount can be deducted from the total Amount that’s to be paid to vendor. |

| 29. | Voucher Adjustment Account 1 | Voucher discount Amount on account 1 | No | Adjustment Accounts. It helps to take advantage of Cash Discount / any promo adjustment etc. can be handled here |

| 30. | Voucher Adjustment Account 2 | Voucher discount Amount on Account 2 | No | Adjustment Accounts. It helps to take advantage of Cash Discount / any promo adjustment etc. can be handled here |

| 31. | Cash Discount | No | The amount of cash discount given on the amount. This provides an option to select the cash discount as a percentage value or as amount (INR). | |

| 32. | Round Off | Rounded off amount | No | This gives the rounded off value of the amount if the amount is in decimal values. |

| 33. | Total | Total amount | Yes | This gives the Final Total amount for the purchase made by the Buyer. |

Once you save a Voucher in AP module, ACTouch ERP will do the following.

- It will close the POR / GRN’s. It can be partially or Fully Closed depending on the Transactions.

- Closing the DB/CR notes, if any.

- Adjustment of Advances, if any.

- Purchase Returns, if any.

- Booking of bank charges to the respective accounts.