GST Returns and TDS Payment to Government

Both GST Returns and Payment and TDS Payment are statutory payments from the businesses and missing it could create problems to the business from Government. Business have to follow the GST Payment and TDS Payment deadline for every month before which the payments are to be made to Govt.

In the last 10 years, every government in the world has become strict to collect taxes and they trace the defaulters with penalty. So its advisable to track and pay them on time.

GST Payment Payable

This is the net amount against which the payment is made to Government. Here you pay to Government the Net of Input and Output taxes. Today GST is covered for many items and services. Example you will do the GST Payments to Products, GST Payments on advance Payments and Receipts, GST Payments for services like commissions or any services provided by consultants etc. Even Bank charges are added with GST service charges too.

TDS Payments (Tax Deducted at sources)

Customer deducts a %age of Tax amount from the total money to be paid to Vendor and its deposited directly by him to Government. This TDS money is reimbursed by Government to the Service Provider as he submits his annual Income Tax Returns. These rules are made to ensure that Payee is responsible to collect the taxes and paid to Government.

These payments are done in online mode.

How to do GST Returns and TDS Payments in ACTouch ERP?

It is important that the TAX PAYMENT should be done from this menu. The reason is,

- When the tax is booked, its booked into an PAYABLE Account such that we know how to much to PAY Government.

- Many times, the customer will not pay FULL Tax amount due to various reasons and we need to track what’s pending to PAY.

- So ACTouch takes care of these internal Tax details and identifies what is “OPEN” and what is “PAID” etc.

- This feature helps many customer to manage their tax payments either partially or Fully.

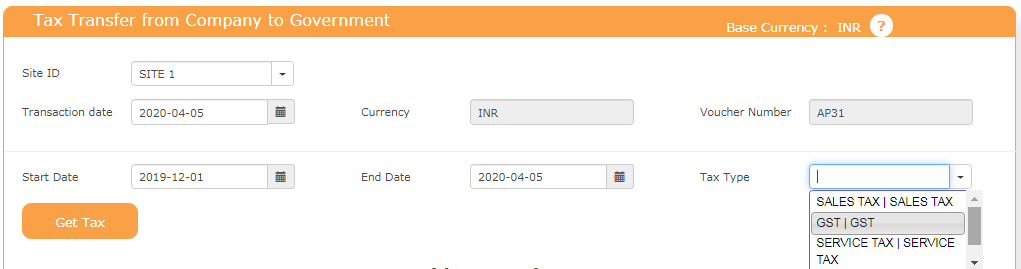

Step-1: Go to GL -> Tax transfer menu and select the DATE Ranges and type of TAX to pay

This gives the total amount to PAY and RECEIVE. A summary menu that helps the business to handle all cases.

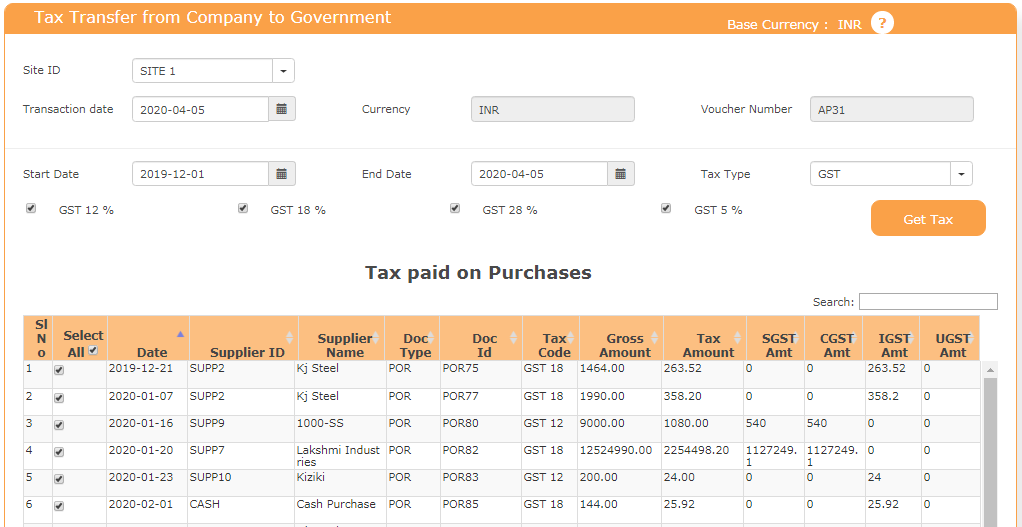

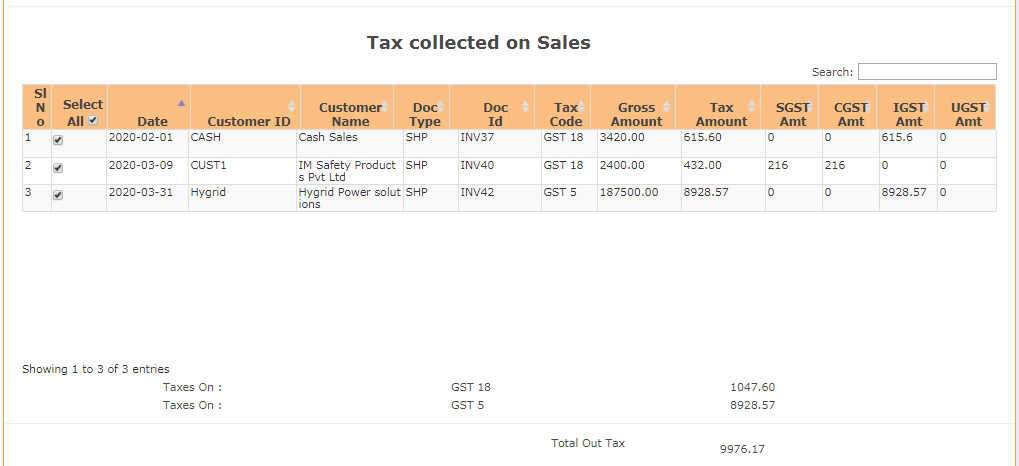

Step-2: Now application will show the Input and Output tax amounts and the difference to PAY GOVT

This is the net amount to Pay Government. Here we show the details of total PAYABLE and total Receivable and the NET AMOUNT either to PAY Government or receive from Government.

We also provide an option to CHOOSE the DOCUMENT on whether to consider for this MONTHS GSTN return or not? This is a good practice to ensure that you do not take unnecessary GST credit against a Purchase Order, while the SUPPLIER has not SUBMITTED his INVOICE.

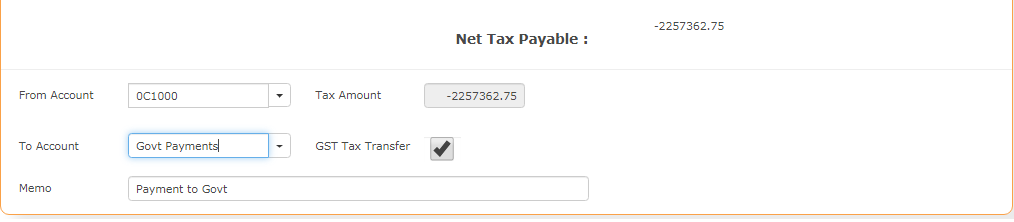

Step-3: Please create a supplier / vendor as “Govt GST Payable”. To this VENDOR make the Voucher from the above screen

This will create the Voucher and also identifies what are all the Invoices or Purchase Receipts are PAID now.

Use this menu to complete the PAYMENTS and this creates the respective Payments vouchers too.

ACTouch also supports those companies that use VAT Sales taxes and its business practices. In India, we use GST, while the rest of the world, it may be VAT / GST Services. Here the GST services is totally different from what we see in Indian context.

In India, we do follow little different process. For the INTER STATE transactions, we do apply IGST taxes, while INTRA STATE (within STATE), we apply CGST (Central GST) and SGST (State GST) taxes and this is 50% each of the total TAX AMOUNT.