How to book Expenses for Machine Purchase or Maintenance work?

How to do a Capital Goods Entry in the accounting system as these are the major investment in companies like CNC Machines, Vehicles, Projects etc and these are amortised for a long duration? So “Book Expenses” or “Expenses booking” is a process of recording the Data and entries into ERP system for Machines or maintenance work or travel or other type of expenses. Depending the stages of the project, part or full portion of projects investments or expenses are capitalised.

Below details would answer following questions

- Record the Machine components purchase and book expenses against Expense / Capital account heads

- Book expenses and maintenance amount spent for a Machine repair. How to book other related expenses?

- Show these expenses under investment side / at annual expenses side for Accounting purpose.

Machine maintenance and booking expenses can be done with multiple options

- Booking the service costs at the time of Receiving the SERVICES or PAYING the money to vendor. You can use Purchase Order – Services to book this

- Issuing the materials to this specific Account at the time of repair or maintenance work.

Book Service costs when you Receive the SERVICES or Capital goods Entries when you PAY the money for Capital Goods

As we explained, we typically book the Capital goods and the expenses related to the same as investments and these amounts can depreciated.

Step-1: Create an Account in “Account Master” to identify the specific expenses / Capital goods entry. It could be for a machine or for a work.

Please create an account under “Account category” as “Repairs”. These accounting details would show in “Profit and Loss” details for a financial year.

Step-2: When you are booking an Expense / Capital goods entry to this category, you can follow 2 approaches

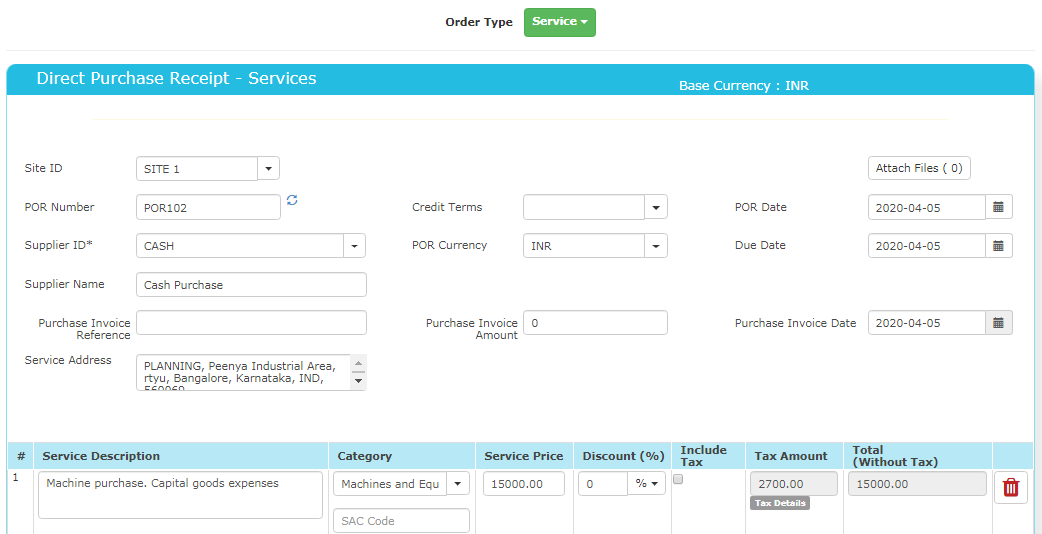

Step-2a – By creating a Purchase Order of Services type.

Go to Purchase Menu and select the “Services” section and create a PO. After that Receive the Services. After this, you can do the payment as regular one from the “PAYMENT Menu”.

Step-2b – Booking Expenses directly in “Expenses and Advance” menu.

So select this “ACCOUNT” and book expense against it. This menu would process the payment immediately.

How to issue the materials to the maintenance work and how to book expenses?

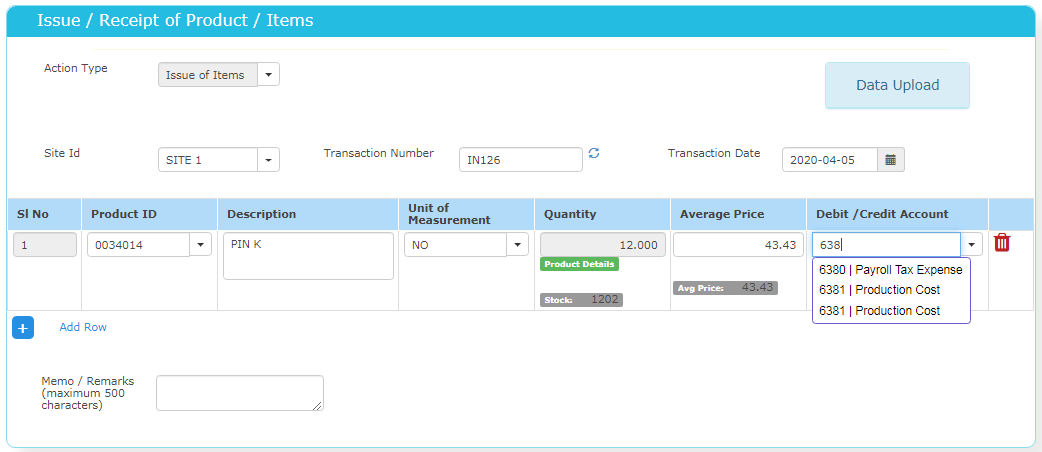

- Go to “Inventory” menu -> “Issue / Receipt of Items”.

- Select the ACCOUNT as “Repair or Maintenance” account.

- When you issue the items, the cost of the ITEM is booked into this account.

In summary, we have 2 options to book the Product and Inventory to capitals goods

- Regular Purchase of items and book them to a Capital Goods Account entry. Booking of capital into Capital Accounts / Asset is important.

- When you issues materials for maintenance and others, the same Capital Account is DEBITED again with the cost of inventory.