Most of the business keep the extra money in a fixed deposit with Banks or lend them to other business for an Interest. So yearly income or the Interest income has to be recognised by the Business as earnings. So how to book interest earned from Bank or other fixed deposits?

One of the important process in Bank Reconciliation is to book the Interest Payments from Bank for the Fixed Deposit that’s done by you. Since this is business related Interest Payments and this amount should be accounted and shown in right accounting heads.

Business cases: Example, in case, you are getting INTEREST PAYMENTS ON THE Fixed Deposit Amount (FD Account) and how to book them in ACTouch ERP for accounting purpose?

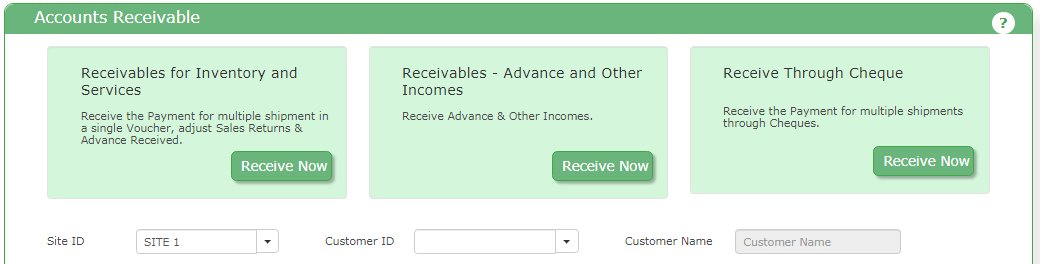

Go to Accounts Receivable menu to book Interest Earned from Bank

Go to “OTHER INCOMES” MENU and book the Interest Earned from Bank / money received from bank into its account.

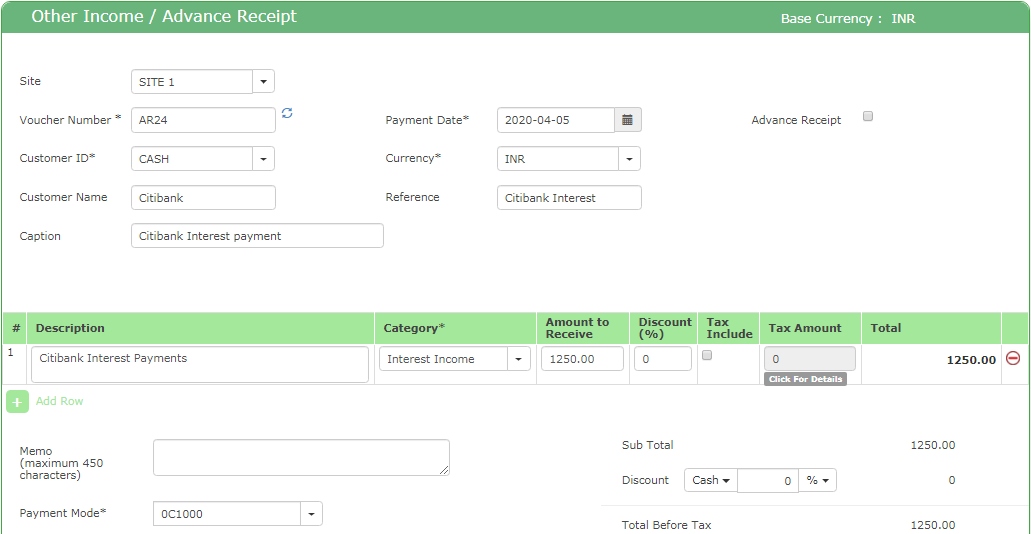

Select the customer as “CASH” or any others where you want to show the sequences of the transactions. Enter the “Reference” and “Caption” field as these appear on the statement.

Enter the “Interest earned” account in the category and amounts.

Payment mode is important to know to which ACCOUNT / BANK ACCOUNT you are booking the money.

Since this is an income, the Bank Account is Debited and Interest income account is credited.

Alternate Way to handle this request of booking the Internet earned from Bank.

Go to General Ledger and create a voucher. Here enter the DB and CR account and pass a GL entry.

- Go to General Ledger

- Select the “Journal Entry” menu

- Enter the DB and CR accounts

- Enter the Amount

- “Save”

This would create a JV for the accounting entries.

The same approach can be used in case of Scrap items Sales with TCS amount. (This is mainly for Indian Business, where the Tax Collected at Source(TCS) to be collected and paid back to Govt.

Post this, check the BANK, ACCOUNT statement to check the amounts. Bank interest earned, Book Bank Interest