How to enter Journal entries to Suspense Account to Receive the money?

What is Journal Entries? Why we do pass entries to individual accounts? How to make Journal Entries? We try to explain the similar concepts here. Suspense accounts entries are like group of accounting entries that we kept aside to adjust the amount later.

Entry to Suspense accounts are a practice used by Accountants when they are not clear on the accounting entries that they need to enter. The advantage of this model, helps the Accountants to complete the transaction and go back and correct the entries at later dates.

In business, you get into a state, where you don’t know who sent money? In Accounting, if any transactions are not clear, then that amount is passed through a Journal Entry to suspense account to post the transactions. Once the details are identified then the transactions are reversed.

This is one of the best thing in Accounting Process / Book Keeping process.

Examples of use of this count is as below.

- While entering the Journals Voucher, you found an Amount that’s not able to attribute to a particular transactions.

- In Bank Statement, you recd a money from a Customer, but not able to identify on “who is this customer”?

- In Inventory transactions, not able to find the Cost units. Please post the transaction to a suspense account and you reverse them later.

Highlights: In this article, we try to cover the Entry to Suspense Accounts details and Suspense Account Journal Entry too.

- What is Journal Entries?

- What is suspense account and how to use it?

- Use suspense accounts and its value in Accounting entries?

- Pass or enter a Suspense accounting journal entries

Journal Entries to Suspense Accounts are also used as a reminder as this account should have a zero balance.

Journal Entries to Suspense Accounts is done to remind the CA’s later to adjust them as technically these values should be ZERO, when we generate Balance Sheets or Profit and Loss sheets.

Steps to follow in ACTouch, a manufacturing ERP to manage and use the suspense accounts for a bank transactions.

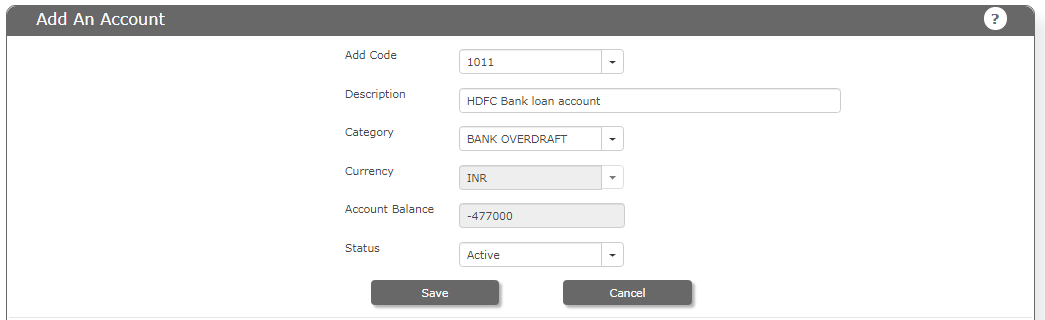

Step-1: Create a Suspense account of type “CASH”

Create a new Suspense Account in “Account Master menu”.

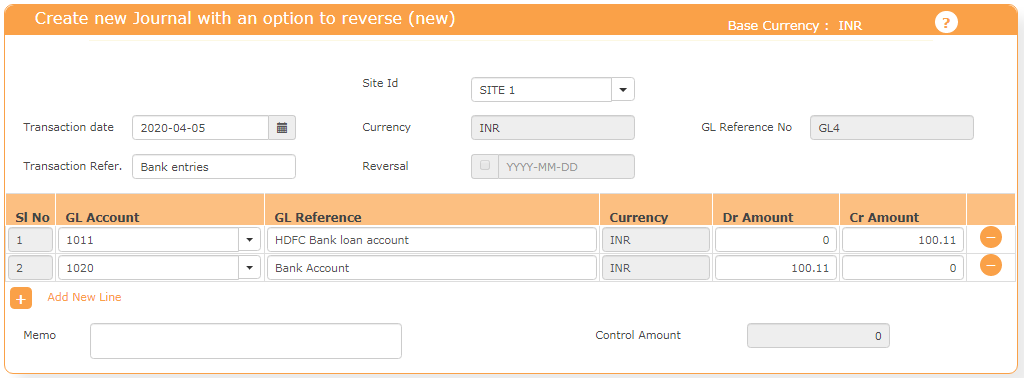

Step-2: Create a Journal entry to DEBIT the amount for the suspense amount

Now pass a journal entry to Suspense account and to the Bank account at “General Ledger -> Journal Entry” screen

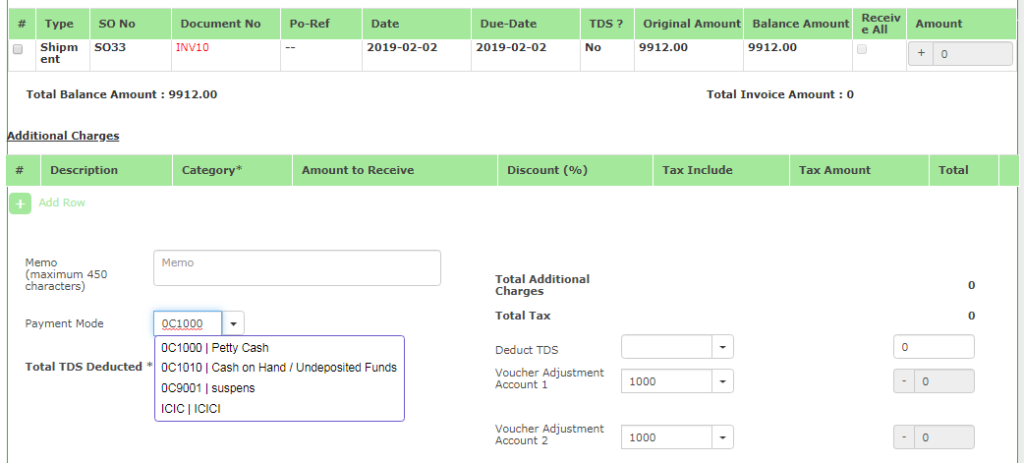

Step-3: Once amount is clarified on which Customer’s it is, go to “Accounts Receivable” menu. Here the AMOUNT is adjusted against the “SUSPENSE ACCOUNT’

Step-4: Check the “Account Statement” to see how much is remaining in the account

This is a standard method, that can be applied to many other variation of adjustment and Payments too.