What is Cheque Bounce / Cheque Returns?

What is Cheque Bounce / Cheque Returns is a situation where the Customer who has paid the money towards purchase of items are not honoured and didn’t pay the money. It has a different way to handle in financial way and procedure to adjust entries.

In Indian context, Cheque is a financial instrument that ensures the Supplier / Vendor that customer is honoring his commitment to Pay for the materials that he supplied. So its important for the Customer to not to get into troubles due to Cheque Bounce or Cheque Returns problems.

What is Cheque Returns?

- What is cheque bounce / Cheque Returns? – This means, the cheque is returned and its not honoured by the bank where you deposited for money collections.

- Why a cheque bounce happens? – There are many reasons including lack of money in the bank account, wrong person Name, Wrong Dates (Expired Cheques), Scratches on the cheque etc.

- What happens if a cheque bounces – First speak to the bank and check what happened. 95% of time, bank would give the reasons on what happened (Point 2). Based on that you can speak to the person who has given the cheque to you.

Earlier Business owners use to give cheques without any consequences in case, the money is not in their account. For the last 2 years, the Cheque Bounce is a criminal offence and the cheque issuers can be jailed without a bail too.

So business owners are very careful with their commitment to payments and monitor the cheques.

How to handle Cheque Bounce / Bounce Cheque Returns cases

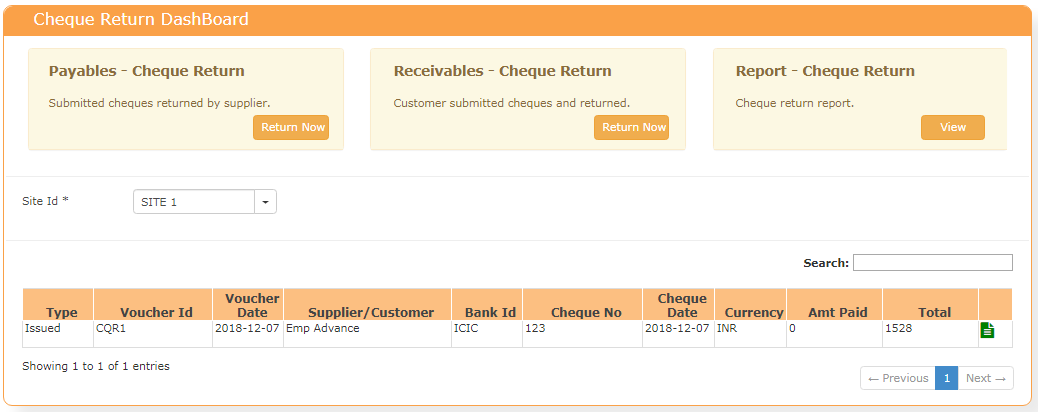

Step-1. Go to “Cheque Returns” menu

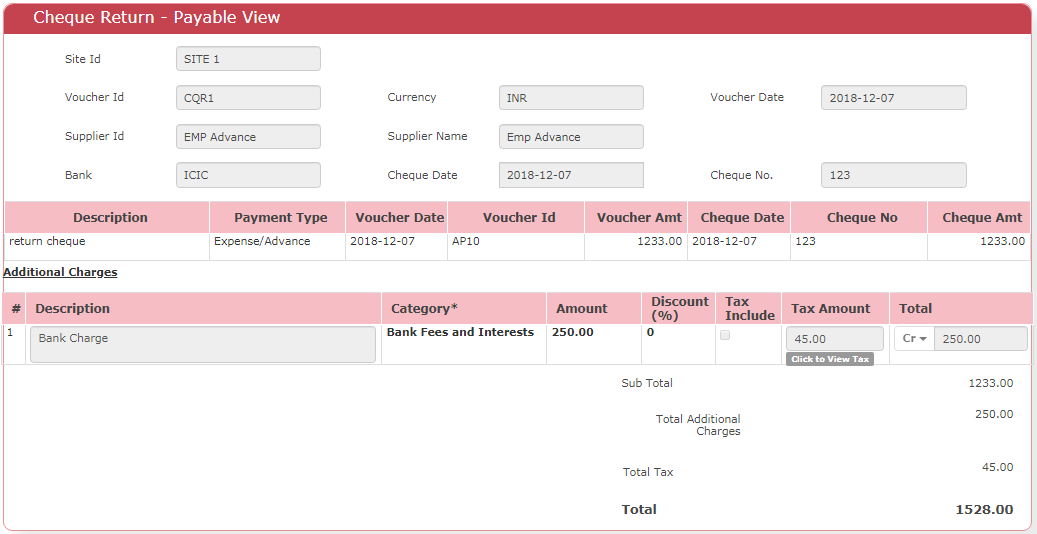

Step-2: Select the SUPPLIER and CHEQUE that’s RETURNED. This will show below details. Add bank charges and applied TAXES, if any.

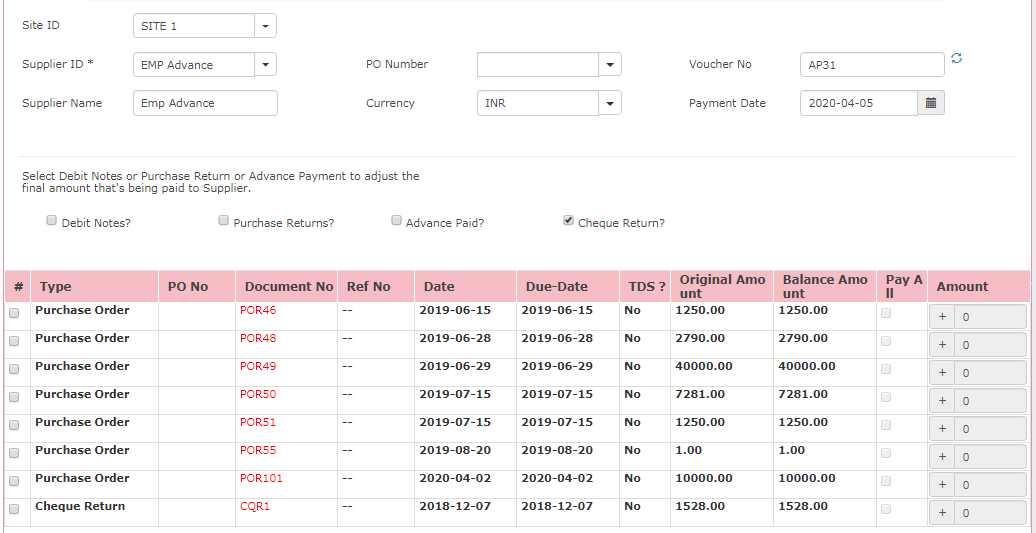

Step-3: You create a CHEQUE RETURN VOUCHER and adjust with other Pending Payments.

- First you need to create a cheque return Voucher to recognise the amount to adjust and any charges to be collected from customer.

- This Voucher would appear in AP Menu payment to handle the settlement.

In Summary, we handle the cheque returns as a VOUCHER and then adjust the same against the Final settlement.

The reasons for the above is as below.

- The earlier voucher and cheque that’s bounced in already shown in Bank statement.

- We cant just delete and update the Financial vouchers and other invoices etc.

- So we have to create a new financial voucher to reflect the changes and also add the Bank charges to claim from customer or vendor.