How to Pay off Car Loans or Vehicle Loans in ERP?

Many times, business has to buy Vehicles or Cars on Bank Loans for the business purpose. Since these are capital assets, follow the below procedure to Pay off Car loans or any other Vehicle Loans or any capital goods thats taken.

The behaviour of this transactions is very different from other transactions as many people take the LOANS to acquire a vehicle. Due to this reason, when a EMI is paid to the Bank towards the Paying off Car loans, it contains 2 components and need to be handled separately.

- Principle Amount

- Interest amount.

In few cases, Banks do not give 100% loans and give only 80%. So the business has to put remaining 20% of the money including Car Insurance etc. In summary, when a business receives an Invoice from car suppliers, it has many components and the way to treat each of them is different.

Step-1: Go to “Account Master” (refer to below image) and create a CAR Account of CATEGORY “FIXED ASSETS”.

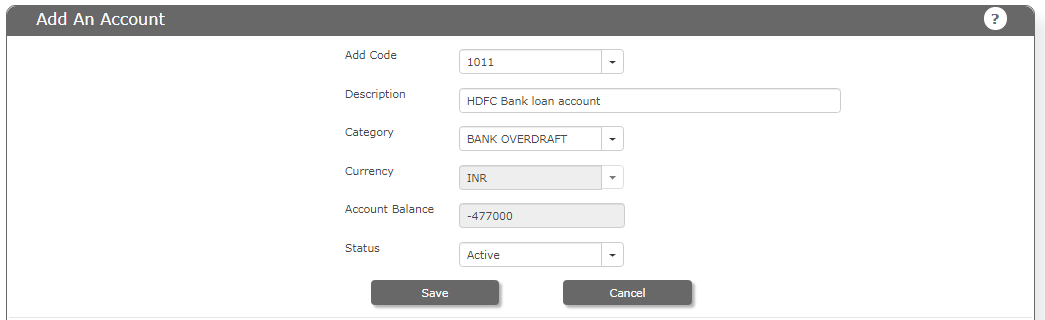

Please create the Loan Account and Car Account that a a fixed asset to company.

Step-2: Also create a CAR LOANS Account in the same Menu.

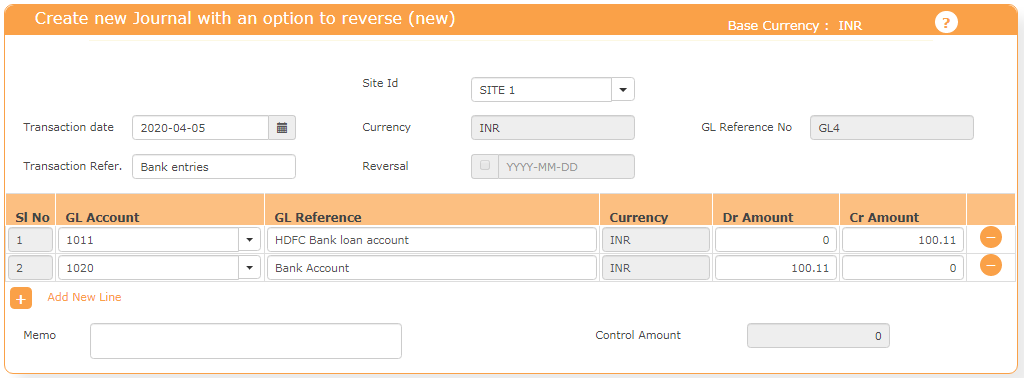

Step-3: Once the CAR Loans is sanctioned – pass a JV as below from GENERAL LEDGER -> Journal Entry screen

DB Car Asset account 250,000.00

CR Car Loan account 250,000.00

See the below image for reference to explain how to pass Journal Entries.

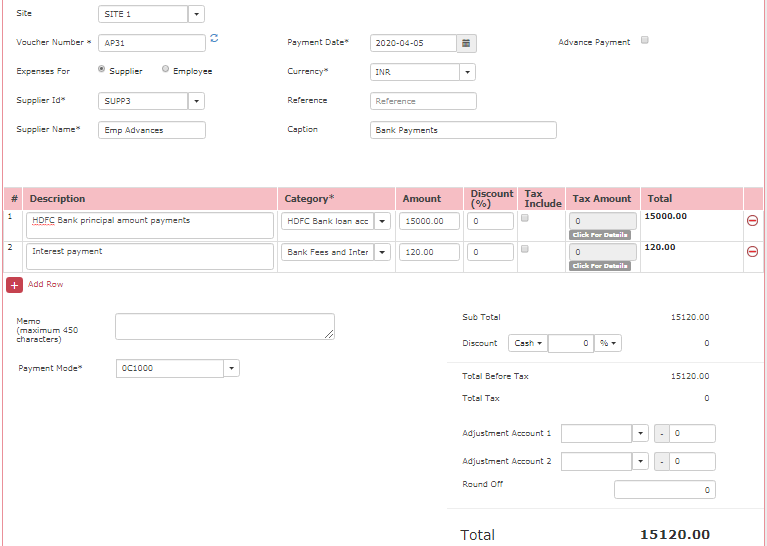

Step-4: When Pay off Car Loans or any payment due comes, use EAP menu and pay the loan amount / EMI – same like previous steps.

Please refer to the below Image for the transaction references

Check the reports to ensue the EMI with Interest and respective accounts are hit properly.